Reports released by the D.C. Fiscal Policy Institute (DCFPI) document the massive disparity in incomes between the top and bottom earners in Washington DC, as well as the lack of affordable housing.

“A Big Gap,” released in March, speaks of the massive influx of wealth to the District area, most of which is connected to federal government contracts, while the working class in the nation’s capital is increasingly left to fend for itself.

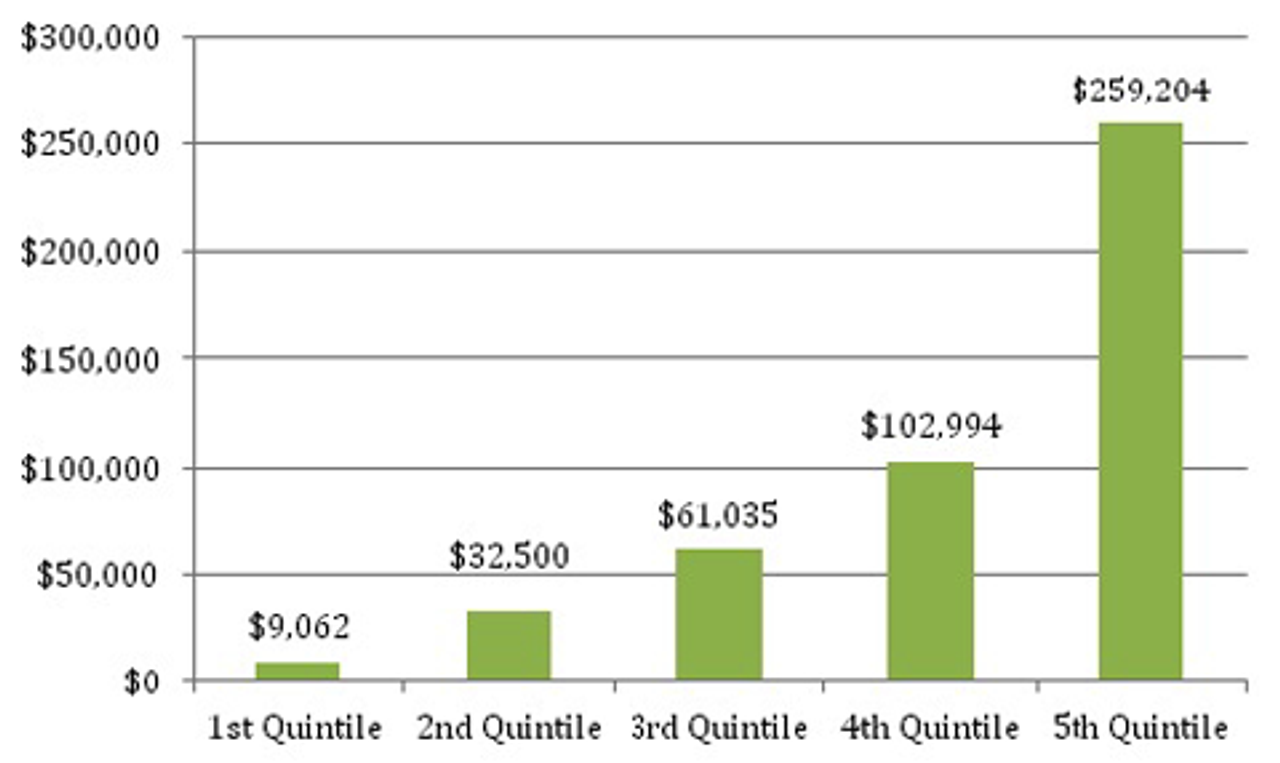

Washington DC falls behind only Boston and Atlanta in terms of the gap between high-income and low-income households. The level of income of the top 20 percent in DC, $259,000, is second only to San Francisco’s top fifth.

Average Income of DC Households by Quintile in 2010

Average Income of DC Households by Quintile in 2010SOURCE: DC Fiscal Policy Institute

The level of pay for the area’s top quintile was nearly 29 times that of the lowest-paid, who made less than $10,000 last year. The top 5 percent in the DC area have incomes averaging $493,000, dwarfing their counterparts in other metropolitan areas of the country, who averaged only $272,000.

In a related story on income inequality in the area, the Washington Post detailed the connection between the massive growth in wealth in the District and private government contracting, an industry that had reaped benefits from the massive buildup of the US defense and intelligence sectors in the aftermath of 9/11.

Citing the wealthy Potomac enclave of Great Falls in Northern Virginia, the Post cites that in the last 10 years average household wealth has increased by 32 percent in this community alone. Nearly one in seven households in Great Falls has an income of $500,000 or more.

Families in the outer suburbs, meanwhile, are struggling to get by. Monsignor John Enzler, president of the Catholic Charities of the Archdiocese of Washington, told the Post, “If they’re not at the poverty level, certainly they’re at the brink of poverty.”

The shifting of wealth away from spending for public needs into agencies directly benefiting US militarism and the suppression of mass opposition has sinister implications. While the last year saw nearly $80 billion in federal contracts given to private firms in the region, there has been a massive cutoff of funds for programs serving the working class.

According to an earlier report by the DCFPI, the recession was accompanied by a massive erosion of funds for public housing programs in the nation’s capital. The 2010 report, titled “Nowhere To Go,” details that while the housing boom of the last decade brought rises in home prices, the real incomes of the majority of DC residents left them with few affordable housing options.

In 2004, the core budget for housing stood at nearly $123 million. By fiscal year 2010, after the official end of the recession was declared, that budget had been cut by nearly 50 percent to $64 million. This amount is poised to fall even further in the wake of the most recent jobs report and the possibility of a second slide into recession.

Between 2000 and 2008, roughly the same period in which the housing bubble developed, the study found that rental units in the area with utilities costing $750 or less declined from 65,000 units to only 49,000. During the same time period, units with monthly costs above $1,500 rose from 12,000 units to nearly 30,000.

For homeowners, total houses in DC valued less than $250,000 fell from 58,000 to only 15,000. While in 2000 such homes made up nearly half of the total supply, they comprised only one-sixth in 2008.

In the period studied, nearly two in five households exceeded the maximum housing affordability standard, meaning total housing expenses exceeded roughly 30 percent of income.

Unsurprisingly, poorer neighborhoods were the hardest hit. The study found that four out of five households making less than 30 percent of the area media income (AMI), or roughly $28,000 for a family of four, were spending over 50 percent of income on housing alone.

Though the DC official poverty level stands at 8.4 percent, or about half the national average, the percentage of those in the District classified as officially poor, or with an income of $22,000 for a family of four, stands at nearly 20 percent.